"Key Drivers Impacting Executive Summary Artificial Intelligence in Fintech Market Market Size and Share

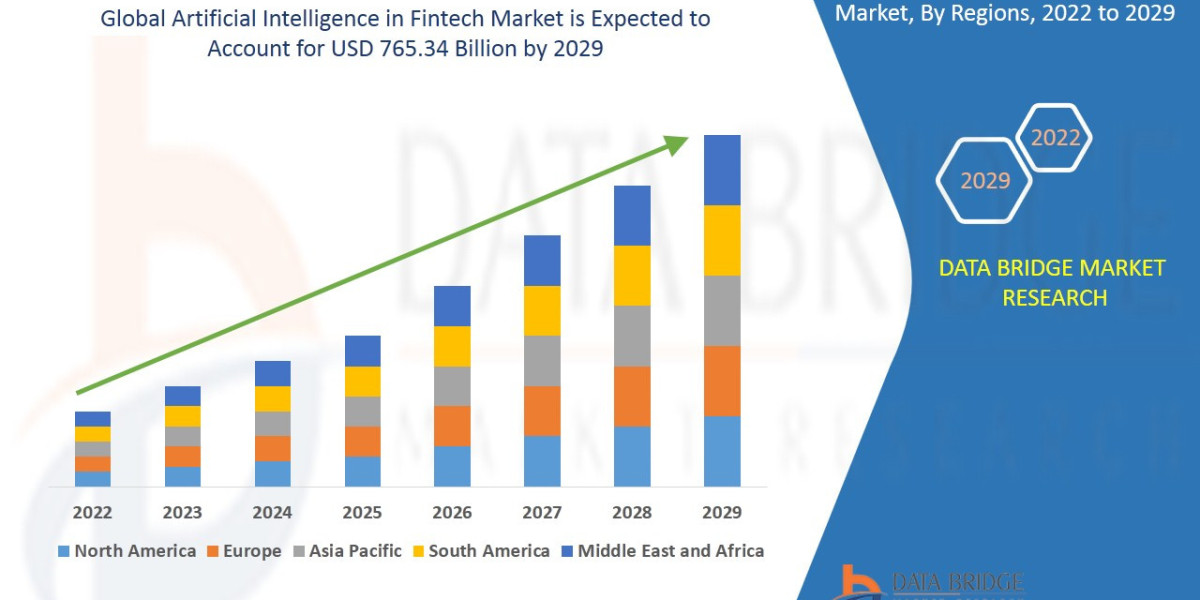

Data Bridge Market Research analyses that the artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period.

Accomplishment of maximum return on investment (ROI) is one of the most wannabe goals for any industry which can be achieved with the finest Artificial Intelligence in Fintech Market Market research report. Market insights of this report will direct for an actionable ideas, improved decision-making and better business strategies. The main research methodology utilized by DBMR team is data triangulation which entails data mining, analysis of the impact of data variables on the market, and primary validation. The wide ranging report is mainly delivered in the form of PDF and spreadsheets while PPT can also be provided depending upon client’s request. To achieve an inevitable success in the business, Artificial Intelligence in Fintech Market Market report plays a significant role.

The large scale Artificial Intelligence in Fintech Market Market report helps in determining and optimizing each stage in the lifecycle of industrial process that includes engagement, acquisition, retention, and monetization. This market research report comprises of different industry verticals such as company profile, contact details of manufacturer, product specifications, geographical scope, production value, market structures, recent developments, revenue analysis, market shares and possible sales volume of the company. It helps companies to take decisive actions to deal with threats in the niche market. The dependable Artificial Intelligence in Fintech Market Market report presents actionable market insights with which businesses can settle on sustainable and lucrative strategies.

Understand market developments, risks, and growth potential in our Artificial Intelligence in Fintech Market Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market

Artificial Intelligence in Fintech Market Industry Trends

Segments

- By Component: Based on the component, the global artificial intelligence in fintech market is segmented into software tools and services. The software tools segment is expected to dominate the market as businesses increasingly adopt AI-powered software applications to streamline operations and enhance decision-making processes.

- By Application: The market is further segmented by application into virtual assistants, business analytics & reporting, customer behavioral analytics, and others. Virtual assistants are expected to witness significant growth due to their ability to improve customer service and engagement in the financial industry.

- By Deployment Mode: The deployment mode segment includes on-premises and cloud-based. Cloud-based deployments are gaining traction among fintech companies due to their scalability, cost-effectiveness, and flexibility.

- By Region: Geographically, the global AI in fintech market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is expected to lead the market, driven by the presence of key market players, technological advancements, and the increasing adoption of AI in the financial sector.

Market Players

- IBM: IBM offers a range of AI solutions for the fintech industry, including Watson AI technology for data analysis and customer insights.

- Microsoft: Microsoft provides AI tools and services for fintech companies, enabling them to leverage predictive analytics and machine learning capabilities.

- Google: Google's AI solutions empower fintech firms with natural language processing, fraud detection, and personalized customer experiences.

- Amazon Web Services (AWS): AWS offers AI services such as Amazon Lex for chatbots and Amazon SageMaker for machine learning models to enhance fintech operations.

- Intel: Intel provides AI technology for fintech applications, with a focus on data security, regulatory compliance, and data processing efficiency.

The global artificial intelligence in fintech market is witnessing rapid growth, driven by the increasing demand for advanced analytics, automation, and personalized customer experiences in the financial services sector. With key players constantly innovating and expanding their AI offerings, the market is poised for further growth and technological advancements in the coming years.

The global artificial intelligence in fintech market is an ever-evolving landscape that continues to transform the financial services sector. As businesses strive to enhance their operational efficiency and deliver more personalized services to customers, the adoption of AI technologies is becoming increasingly prevalent. One key trend that is shaping the market is the convergence of AI with other emerging technologies such as blockchain, Internet of Things (IoT), and big data analytics. This integration is enabling fintech companies to develop innovative solutions that revolutionize how financial services are delivered and consumed.

Moreover, regulatory advancements and compliance requirements are also driving the uptake of AI in fintech. With stringent regulations governing the financial industry, including data privacy laws and anti-money laundering regulations, AI-powered solutions offer enhanced capabilities for risk management, fraud detection, and regulatory compliance. Fintech companies are leveraging AI to strengthen their security measures, detect suspicious activities, and ensure adherence to regulatory standards, thereby mitigating operational risks and protecting customer data.

Another significant factor influencing the market is the increasing focus on customer experience and engagement. AI technologies such as virtual assistants and personalized recommendation engines are enabling fintech firms to deliver more tailored services to their clients. By analyzing vast amounts of data in real-time, AI systems can provide personalized insights, recommendations, and support to customers, thereby enhancing overall satisfaction and loyalty. The ability of AI to understand customer preferences, behavior, and needs is revolutionizing the way financial services are delivered, creating more engaging and seamless interactions between customers and financial institutions.

Furthermore, the proliferation of AI-driven automation is driving operational efficiencies and cost savings for fintech companies. By automating routine tasks, data processing, and customer service functions, AI solutions are enabling organizations to streamline their operations, reduce manual errors, and allocate resources more effectively. This increased efficiency not only improves bottom-line performance but also frees up human capital to focus on higher-value tasks such as strategic decision-making, innovation, and business growth.

In conclusion, the global artificial intelligence in fintech market is poised for continued growth and innovation as businesses embrace AI technologies to drive digital transformation and competitive advantage. By harnessing the power of AI for advanced analytics, automation, and personalized customer experiences, fintech companies can unlock new opportunities for growth, enhance operational efficiency, and deliver superior services to their clients. With key market players leading the way in developing cutting-edge AI solutions, the future of fintech looks increasingly intelligent, dynamic, and customer-centric.The global artificial intelligence in fintech market presents a promising outlook characterized by rapid growth, innovation, and evolving trends. One of the key drivers propelling this market is the increasing demand for advanced analytics, automation, and personalized customer experiences within the financial services sector. Fintech companies are turning to AI technologies to enhance operational efficiency, improve decision-making processes, and deliver tailored services to customers. As a result, the market is witnessing a surge in adoption as businesses recognize the transformative potential of AI in driving digital transformation and gaining a competitive edge in the industry.

The convergence of AI with other emerging technologies such as blockchain, IoT, and big data analytics is a notable trend shaping the AI in fintech market. This integration enables fintech firms to develop innovative solutions that redefine how financial services are delivered and consumed. By leveraging AI in conjunction with these complementary technologies, companies can unlock new synergies, enhance security measures, and create more efficient and customer-centric financial solutions.

Regulatory advancements and compliance requirements also play a significant role in driving the uptake of AI in fintech. With the financial industry being subject to stringent regulations and data privacy laws, AI-powered solutions offer enhanced capabilities for risk management, fraud detection, and regulatory compliance. Fintech companies are increasingly relying on AI to fortify their security measures, detect anomalies, and ensure adherence to regulatory standards, thereby mitigating operational risks and safeguarding customer data.

Moreover, the relentless focus on customer experience and engagement is fueling the adoption of AI in fintech. AI technologies such as virtual assistants and personalized recommendation engines enable companies to deliver bespoke services to clients by analyzing their preferences, behavior, and needs in real-time. This level of personalization enhances customer satisfaction, loyalty, and overall engagement, ultimately reshaping the dynamics of the financial services industry.

Furthermore, the shift towards AI-driven automation is revolutionizing operational efficiencies and cost savings for fintech companies. By automating repetitive tasks, data processing, and customer service functions, AI solutions empower organizations to optimize their operations, minimize errors, and allocate resources more efficiently. This heightened efficiency not only bolsters financial performance but also liberates human capital to focus on strategic initiatives, innovation, and value-added activities.

In essence, the global artificial intelligence in fintech market is marked by continuous growth and innovation as businesses harness AI technologies to drive digital transformation, operational excellence, and superior customer experiences. By embracing AI for advanced analytics, automation, and personalized services, fintech companies are poised to unlock new avenues for growth, enhance competitiveness, and deliver unparalleled value to their clientele. As market leaders pave the way with cutting-edge AI solutions, the future of fintech promises to be intelligent, dynamic, and customer-centric, ushering in a new era of innovation and prosperity in the financial services sector.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market/companies

Artificial Intelligence in Fintech Market Market Reporting Toolkit: Custom Question Bunches

- What are the most traded product types?

- How is digitalization reshaping the Artificial Intelligence in Fintech Market Market industry?

- How do urban and rural markets differ?

- What export-import trends affect this Artificial Intelligence in Fintech Market Market?

- How many patents are filed annually in this space?

- What share of revenue is derived from online channels for Artificial Intelligence in Fintech Market Market?

- What CSR initiatives are companies undertaking?

- Which segments show seasonal sales fluctuations?

- How is customer retention being improved?

- What are the recent developments in product packaging?

- How are logistics challenges being addressed?

- What is the ROI for major players for Artificial Intelligence in Fintech Market Market?

- What are the top-performing sales channels for Artificial Intelligence in Fintech Market Market?

- How has the pandemic affected supply and demand for Artificial Intelligence in Fintech Market Market?

Browse More Reports:

Europe Japanese Restaurant Market

Global Polyethylene (PE) Pipes Market

Global Rare Earth Metal Market

Global Robotic Process Automation RPA Software Market

Global Point-Of-Care-Testing (POCT) Market

Global Dried Fruits Market

Global Digital Agriculture Market

Global Aloe Vera Market

Global Luxury Furniture Market

Global Natural Fibers Market

Global Nicotine Pouches Market

Global Athletic Footwear Market

Global Bacterial Infection Diseases Market

Global Glass Substrate Market

Middle East and Africa E-Sim Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"